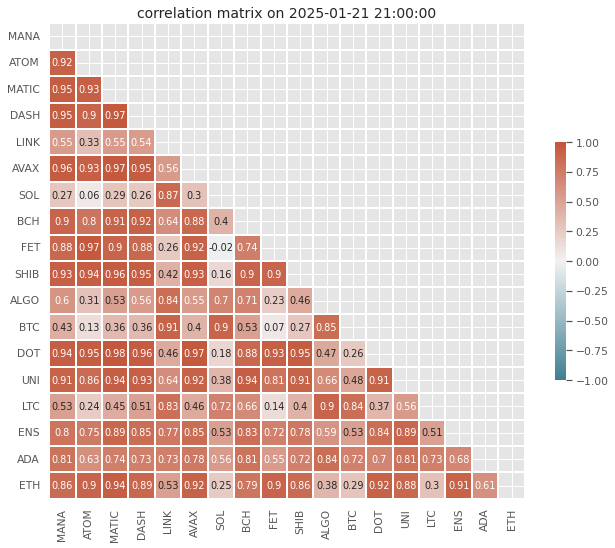

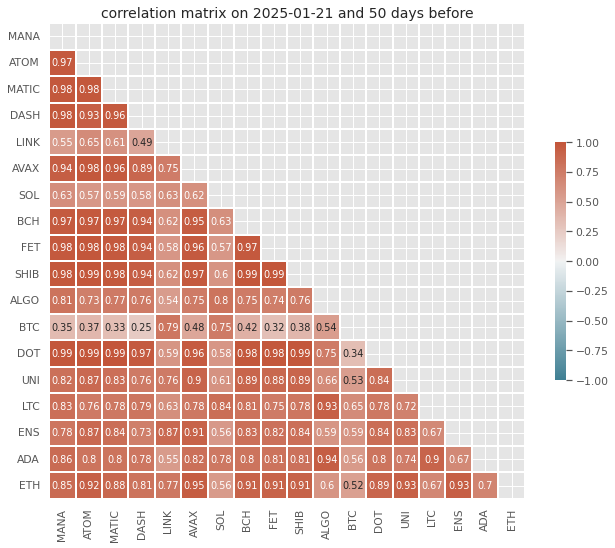

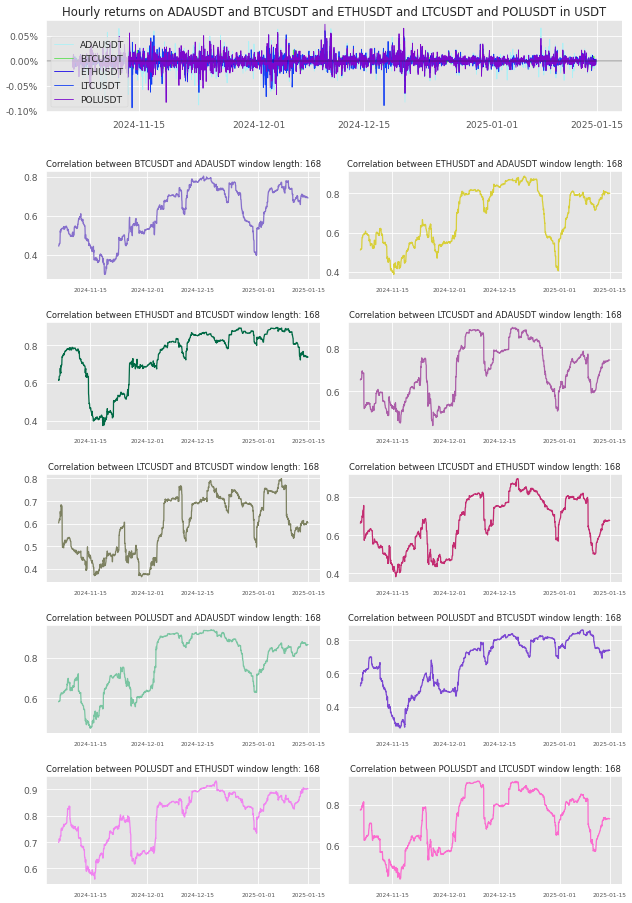

Correlation Matrix

Daily and hourly correlation. The source is Coinbase.

This page is updated daily at 12:00 PM GMT.

Return Correlation

(Closer to 1 - Returns are similar, closer to 0 - Returns are not similar)

More Charts

Understanding 50-day and 200-day Moving Average Analysis

The 50-day and 200-day moving averages are important tools used in technical analysis to assess trends in the market.

What are Moving Averages?

A moving average smooths out price data by calculating the average price over a specific number of days:

- 50-day MA: Represents the average price over the last 50 days and is a shorter-term indicator.

- 200-day MA: Represents the average price over the last 200 days and is a longer-term indicator.

Key Concepts

Two important signals traders watch for when these moving averages cross:

- Golden Cross: When the 50-day MA crosses above the 200-day MA, indicating a potential upward trend (bullish signal).

- Death Cross: When the 50-day MA crosses below the 200-day MA, indicating a potential downward trend (bearish signal).

How to Use in Trading

The 50-day MA helps identify short-term trends, while the 200-day MA helps determine long-term trends:

- If prices are above both moving averages, it suggests a strong uptrend, and traders might consider buying.

- If prices are below both moving averages, it suggests a downtrend, and traders might consider selling or holding off on buying.